In this post, we will check out the 10 best stock trading and investment apps for beginners in 2023.

Investing in the stock market can be a daunting task, especially for beginners. However, with the rise of technology, investing has become more accessible and convenient than ever before.

Stock trading and investment apps have made it possible for people to invest in the stock market from their mobile devices, anytime and anywhere.

In this article, we will introduce you to the 10 best stock trading and investment apps for beginners in 2023.

These apps have been carefully selected based on their user-friendly interfaces, low fees, educational resources, and investment options.

Whether you are new to investing or a seasoned investor, these apps can help you make informed investment decisions and grow your wealth over time. So, let’s dive in and discover which apps can help you start investing in the stock market today!

Table of contents

Best Stock Trading and Investment Apps for Beginners 2023

1 Acorns

Acorns is a micro-investing app that rounds up purchases and invests the change. Acorns are free to use and work on both iOS and Android devices.

The app makes investing simple for beginners by automatically investing your money for you based on your risk tolerance level and investment goals.

You can also choose to invest manually in a specific stock or ETF if you want more control over where your money goes.

Acorns allow users to invest as little as $5 per trade, making it ideal for people who want to get started without putting too much at stake at once.

With more time, your recurring subsidies will grow into a larger portfolio in the future. The company name itself suggests (Acorns): start a little like an acorn but expand strong into a powerful oak tree.

This is one of the best attributes of Acorns. Any beginners and small businesses start with a small amount and grow with time.

The Robo-advisor micro-investing app sets a monthly fee for users for equipping investment advice via its Robo-advisor advanced functionality.

Presently, the service has two offerings which include Acorns Personal for $3/mo and Acorns Family for $5/mo.

These subscriptions deliver diverse products which work well with the goals of beginners and small businesses who want to manage money prudently. Acorns top the list of best stock trading and investment apps for beginners.

Their plans come as follows:

- Acorns Personal ($3/mo):

- Acorns Invest: Invest your spare change with Round-Ups

- Acorns Later: Take advantage of potential tax benefits by contributing to your Acorns Later account.

- Acorns Spend: This benefit acts as your bank account, presenting free withdrawals at over 55,000 ATMs nationwide and no account fees, and the capability to earn up to 10% bonus investments

- Acorns Family ($5/mo):

- Everything in Acorns Personal (Acorns Invest, Later, and Spend)

- Acorns Early: This lets you take benefit of the best way to invest $1,000 for your child’s future and can guide you on how to invest as a teenager or minor through opening a custodial account.

Top Features:

- A diversified portfolio

- Retirement planning

- Earn money when you do shopping

Pros:

- Automatically rebalances your portfolio by investing your leftover money

- A portfolio built by experts

Cons:

- You can not create your portfolio on your own

- Monthly fees

2 M1 Finance

M1 Finance is a Robo-advisor that helps you invest in low-fee ETFs. It has a $5/month minimum, and there is no account minimum.

M1’s app allows you to manage your investments through its unique “Concierge” feature, which automatically buys or sells shares based on your investment goals and risk tolerance.

The app also offers access to over 4,000 no-transaction-fee (NTF) mutual funds and ETFs from leading providers like Vanguard, BlackRock iShares, and Charles Schwab Investment Management Inc.

With no commission fees for buying or selling fund shares via the app — only mutual funds available through M1’s brokerage platform have any transaction fees associated with them.

The best feature we like about what we like most about this app is the finance is its ability to make recurring deposits that automatically get invested into your portfolio.

M1 Finance is well known investing app for beginners as it helps with building wealth by automating your investments into diversified portfolios.

M1 Finance is as easy as possible as it does most of your investment works automatically so you don’t have to worry about things related to investing.

The capability of M1 Finance to automatically rebalance your portfolio with your stated asset allocation targets at regular intervals has been shown to enhance overall portfolio performance.

It does so by pushing outperforming funds into underperforming ones, grabbing a deal effect over time.

The app has no account minimum unless you decide to unlock an IRA, for which you’ll need to deposit of minimum $500.

Top Features:

- Low-interest

- Trade with $0 commission

- Automated money transfer, based on your pre-set conditions

Pros:

- Accumulate a bonus when you switch to M1 Finance

- No minimum deposit

- No commission on trade

Cons:

- No mutual funds trading

3 Public

The Public is an app that anyone can use, and it’s free. The public has a super simple interface, so it’s great for beginners who want to get their feet wet with stock investing.

Public allows you to invest in stocks, ETFs (exchange-traded funds), cryptos, and a lot more. It’s perfect for long-term investors interested in growing their money over time.

The public is a commission-free investment app for beginners that permits stock and ETF trades.

For those interested in starting to trade on Public, just sign up for Public, open an approved brokerage account, and deposit funds into your account, you qualify to receive a free slice of stock.

The value of the slice of stock you receive varies from $3 to $300 and the amount designated for each redemption is random. This offer is available to new users only.

Pros:

- No trading commissions

- Fractional shares

Cons:

- Finite investment options

- No investment analysis tools

4 Robinhood

The Robinhood app is a great choice for beginner investors. The app is mobile-only and has no minimum balance requirements, making it a low barrier to entry for beginners.

Users can buy or sell stocks at market price. There is plenty of functionality that this app can provide and comes with a neat user interface and fundamental research tools.

Robinhood became the first commission-free stock trading app by cutting trading commissions to $0.

The service offers commission-free stock trading, as well as the capability to make ETF trades and partake in options trading and penny stock investing—all commission-free.

Robinhood doesn’t support mutual funds on its mobile app or desktop trading platforms.

It’s always one of the go-to tools for investors. They also allow fractional shares, cryptocurrency investing, and a lot more features.

Top Features:

- Start investing with as little as $1

- Trade with cryptocurrencies

- The app lets you receive your paycheck, pay rent, and much more.

Pros:

- Commission free trading

- No minimum balance demanded

- Crypto exchanges

Cons:

- No 401(k) accounts

- No pass to mutual funds

5 MooMoo

Moomoo does not need any introduction in this list. It is a commission-free trading platform for stocks, ETFs, and options.

Moomoo is well known for preferring simplicity and ease of use. This app provides stock traders with an integrated platform with effective tools to improve their trading insights and abilities.

Moomoo also allows easy analysis and stalking functions with its AI tools. Additionally, it delivers free resources to prepare your market sensitivity and understanding, including complete dimensions and 24/7 financial news handpicked by Moomoo’s editorial team.

The app also presents paper trading functionality with real-time data. So if you want a professional, technical analysis platform for research and trading, Moomoo would be a great choice.

Pros:

- Free stock charting software

- Free paper trading

Cons:

- No Robo-advisor functionality

6 WeBull

WeBull is a new app that focuses on ETFs or exchange-traded funds. More specifically, it helps you buy and sell them.

It came into the stock trading world in 2018 when it started contesting Robinhood for market share.

The company provides access to trade on your smartphone, tablet, or desktop.

WeBull is ideal for beginners because it’s so simple to use and has such an intuitive interface. The app gives you all the information you need about the current price per share and historical price movement.

All while giving you an at-a-glance view of how well it performs against other investments like stocks or bonds.

The app also alerts users when there’s been a major change in an investment’s market value (like if its price drops).

It charges no commissions for the trade. Webull also delivers you the key to several robust tools to use for in-depth trading analysis.

Webull is an investing app that offers you the right to invest in tons of tradable items and have a diversified portfolio, with market analysis tools that can give you accurate insights into the market trends.

If these account features sound attractive then Webull is just for you.

Top Features:

- Easily analyze market trends for investing

- A broad range of trading options

- 24/7 customer service

Pros:

- Zero trade commission

- No minimum balance required

- Wide range of investment products

- Analysis tools

Cons:

- No crypto exchanges

7 Betterment

Betterment is a Robo-advisor that uses algorithms to manage your investments. This makes it a good choice for beginners because it’s easy to use and has low fees.

Betterment also offers no minimum investment and no trading fees, so you don’t have to worry about opening an account with thousands of dollars if you’re just starting out (or if you want to give yourself some flexibility).

The service does not authorize you to invest in individual stocks but will automatically put deposits into fractional bits of index funds ETFs aligned with your portfolio goals.

The elements of this platform surely make this app one of the best investment apps for beginners. It is most suited to investors looking to diversify immediately as they make assistance to their accounts.

It delivers automated investing features, tax-loss harvesting, retirement planning, and much more at nominal prices.

Additionally, based on your planned financial goal, the company delivers investment recommendations by tailoring your portfolios to achieve these goals.

Betterment is now a popular choice for investors who want to invest toward specific goals without the necessity for any investing experience for a fair price.

Top Features:

- Automated investing and portfolio rebalancing

- Tax loss harvesting

- Retirement planning

Pros:

- Invest as you want or try automated investing

- Affordable pricing

- Guidance on investing

Cons:

- Shortage of Real Estate funds

8 Stash

Stash is a free app that helps you invest in a diversified portfolio of low-cost ETFs. With Stash, investors can get started with just $5 and build a portfolio that’s right for them.

Stash serves as a low-cost, all-in-one financial platform and stands number 8 in our list of best stock trading and investment apps for beginners.

While the app is mostly known for automating investing, which allows the app to actively select stocks to trade.

Stash proposes custodial accounts for beginners or those under the age of 18. Getting started earlier on your investing journey can create long-term wealth over time.

Stash comes with a recurring monthly fee and provides a full suite of products for financial growth. It does not levy trading commissions for your investment holdings nor does it have an account minimum. Stash is number 8 in our list of best stock trading and investment apps for beginners in 2023.

Top Features:

- Retirement planning

- Tax benefits

- Allows you to invest in fractional shares

Pros:

- Investment advice based on stock analysis

- Tax benefits for retirement investing

- Fractional shares

Cons:

- No tax loss harvesting with savvy portfolios

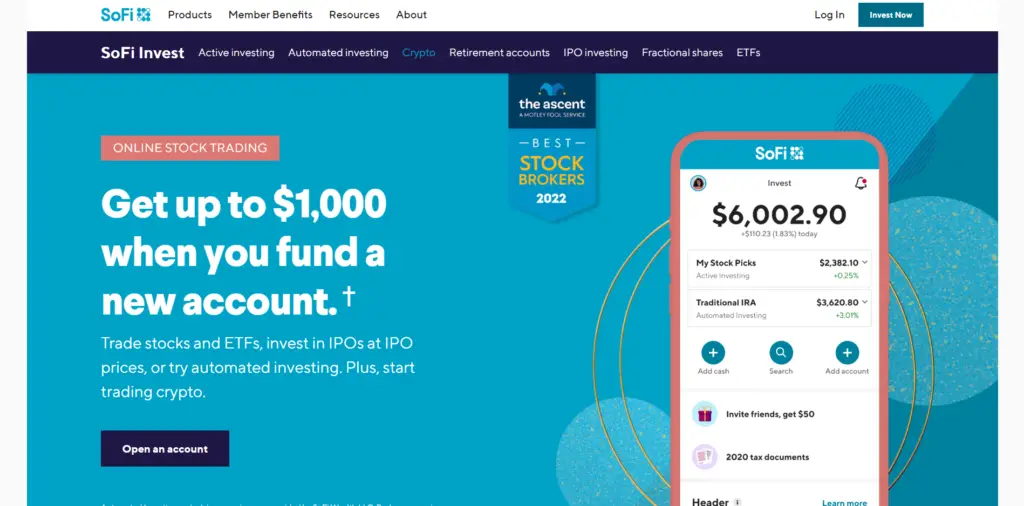

9 SoFi Invest

SoFi Invest is a stock market app that allows you to trade in stock, and ETF trades alongside cryptocurrency.

SoFi Invest is a one-stop destination for all your finances. With SoFi Invest, you can take the help of an autonomous investment feature for your spare money, trade in cryptocurrencies can lay for a loan, and a lot more.

SoFi doesn’t offer options trading or mutual funds. The service also provides you the ability to trade actively.

The company wants to benefit all customers who have an appeal to enhance their financial situation alongside partaking in their other personal finance products like money management, credit cards, and a lot more.

Top Features:

- Allow trade in cryptocurrencies

- Fundings loans on low-interest rates

- Automated investing feature

- No fees

Pros:

- Investing options for beginners

- No fees

- Crypto exchanges

Cons:

- Fewer number options for investing

10 Vanguard

Vanguard is a brokerage firm that offers a variety of investment options. It’s best for long-term investing, as it’s considered one of the most stable investment firms in the world.

Vanguard is also known for offering low-cost funds and ETFs (exchange-traded funds), which are great for beginners who want their portfolios to grow without spending much money on fees.

Vanguard is ideal for investors with high-risk tolerance since its performance won’t be affected by market volatility as much as other companies’ investments might be.

These low-cost investments have saved retail investors billions of dollars over the years, letting their brokerage account returns compound further.

Vanguard excels as a free stock trading platform when you desire to buy and sell Vanguard securities like index fund ETFs or mutual funds. You pay no commissions on their ETF products like VTI, or mutual funds like VTSAX and VFIAX. Vanguard is number 10 in our list of best stock trading and investment apps for beginners in 2023.

Conclusion

There are many apps available to assist beginning traders. You can use the app to invest in a variety of assets, from individual stocks or ETFs, bonds, and cryptos, to currencies and commodities.

While investors should always do their own research and never trade based solely on the advice of an app, these nine apps can be a great place to start. They offer a variety of tools that are easy to use and helpful for beginners looking for guidance.

Disclosure: Our content is reader-supported. If you click on certain links we may make a commission. Learn More.

Discover more from Sportshubnet

Subscribe to get the latest posts sent to your email.