In this post, we will check out the 10 best precious metals IRA companies in 2023.

Precious metals, such as gold, silver, platinum, and palladium, have been used as a store of value and a hedge against inflation for centuries.

In recent years, more and more investors have turned to precious metals as a way to diversify their portfolios and protect their assets. One popular way to invest in precious metals is through a Precious Metals IRA.

A Precious Metals IRA is an Individual Retirement Account that allows investors to hold physical precious metals as a part of their retirement savings.

The metals are held in a custodial account and the investor receives tax benefits similar to a traditional IRA. However, not all IRA companies offer precious metals as an investment option.

To help investors choose the right IRA company for their precious metals investments, we have compiled a list of the 10 best Precious Metals IRA companies for 2023.

These companies have been evaluated based on factors such as fees, selection of precious metals, customer service, and reputation in the industry. By choosing one of these top companies, investors can have confidence in their precious metals investments and enjoy the tax benefits of a Precious Metals IRA.

Why Use a Precious Metals IRA?

A Precious Metals IRA is a type of individual retirement account that allows investors to hold physical precious metals, such as gold, silver, platinum, and palladium, as part of their retirement portfolio.

Precious Metals IRA provides a way to diversify an investment portfolio, reduce risk, and protect against inflation. Precious metals are considered a safe haven asset, meaning they tend to retain their value during times of economic uncertainty and market volatility.

As such, investing in precious metals can help protect against potential losses in other investments during market downturns.

Another advantage of investing in a Precious Metals IRA is that the metals held in the account can be used to hedge against inflation. Inflation is the decline in the purchasing power of money over time, and it can erode the value of traditional investments, such as stocks and bonds. Precious metals, on the other hand, have historically retained their value during times of inflation. Therefore, by holding physical precious metals in a Precious Metals IRA, investors can protect their retirement savings from the effects of inflation.

Furthermore, owning physical precious metals in a Precious Metals IRA allows investors to have more control over their retirement portfolio. Unlike traditional IRA investments that are managed by a third-party custodian, physical precious metals are owned and stored by the investor. This provides investors with the ability to access and sell their metals at any time, as well as the peace of mind that comes with physically owning an asset.

Overall, a Precious Metals IRA can be a valuable addition to a retirement portfolio. It can provide diversification, protection against market volatility and inflation, and greater control over one’s retirement savings. However, like any investment, it is important to carefully consider the risks and benefits before investing in a Precious Metals IRA and to seek advice from a financial professional.

10 Best Precious Metals IRA companies 2023

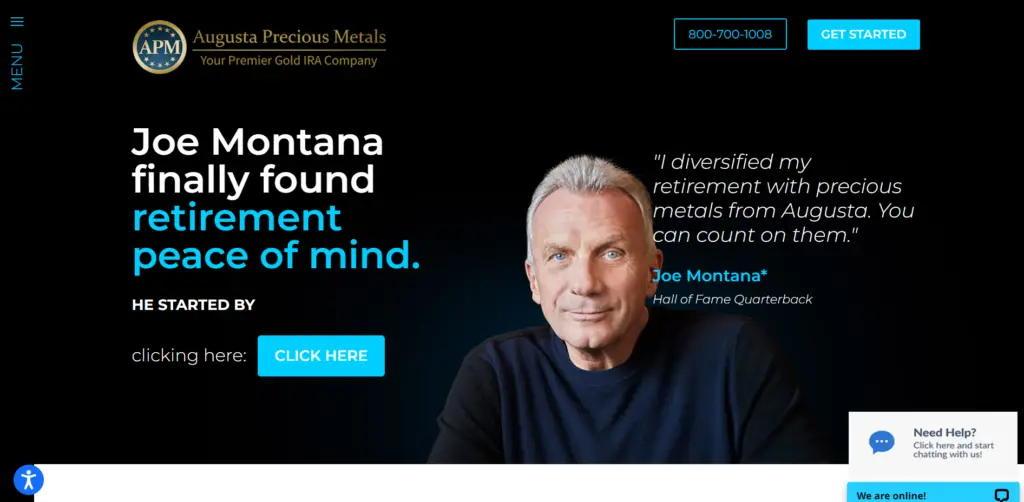

1 Augusta Precious Metals

Augusta Precious Metals is a good precious metals IRA company. They have a good reputation, they have a very good website and they have excellent customer service.

Augusta Precious Metals has established itself as one of the best gold IRA companies in the market due to its transparent fee system and commitment to customer satisfaction.

They provide clients with an upfront breakdown of all expenses related to opening and maintaining a gold IRA account, which helps clients prepare and make informed decisions. This level of transparency fosters confidence in the client, which can lead to better investment decisions.

In addition to transparency, Augusta Precious Metals also offers a money-back guarantee and price protection policies that minimize risk for first-time gold IRA owners and investors.

These features demonstrate the company’s commitment to customer satisfaction and its willingness to stand behind its services.

Augusta additionally supports its customers’ confidence by proposing a 100% money-back guarantee for new customers and guaranteed fair pricing along with seven-day price protection.

If you’re looking for a good way to invest your retirement savings into precious metals through an Individual Retirement Account (IRA), this is one of the best gold ira companies out there!

Pros

- Low-cost

- Money-back guarantee

- Insured fair pricing on purchases

Cons

- No minimum investment mentioned

- No online purchases

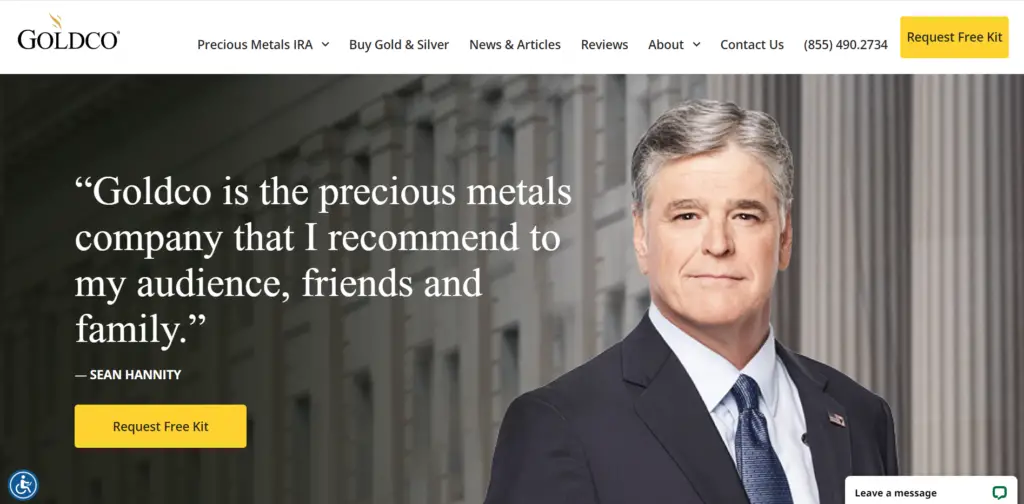

2 Goldco

Goldco offers a variety of precious metals IRA which includes gold and silver products, including coins, bars, and rounds. The company is a well-known gold IRA company that’s been around since 2006.

Goldco is a reputable IRA company that provides brokerage services for precious metals and specializes in creating self-directed precious metals IRAs.

One of their core strengths is their ability to help their clients navigate the process of rolling over assets from an existing 403(b), 401(k), or TSP to a self-directed precious metals IRA.

This includes assisting with the necessary paperwork and selecting storage and custodial services approved by the IRS.

Another key feature of Goldco is its excellent customer service. They provide support to their clients before, during, and after establishing their IRA account, which helps foster long-term client relationships.

In addition, Goldco offers educational resources to help clients make informed decisions about their precious metals investments.

To set up an IRA with Goldco, clients need to sign an agreement and then roll over assets from their existing retirement accounts to fund the IRA. Once the IRA is funded, clients can choose which precious metal to purchase, either gold or silver.

Although Goldco specializes in silver and gold IRAs, they do not offer a wide variety of precious metals beyond those two options. However, their focus on these two metals means they have in-depth knowledge and expertise in the gold and silver markets.

Overall, Goldco is a cost-effective IRA company with an A+ rating from the Better Business Bureau that provides quality customer service and educational resources to help clients navigate the process of setting up a self-directed precious metals IRA.

If you’re on the verge of working with Goldco, you can ask for a free kit to understand more about the company. This kit contains a printed guide, an audio guide, and a video guide that responds to questions about:

- How to invest in precious metals

- How to grow your retirement account

- How precious metals can give you more control over your assets

Pros

- Endorsements from well-known public figures.

- A ton of articles and reviews to read.

- Free start-up kit

Cons

- Prices aren’t observable on their website.

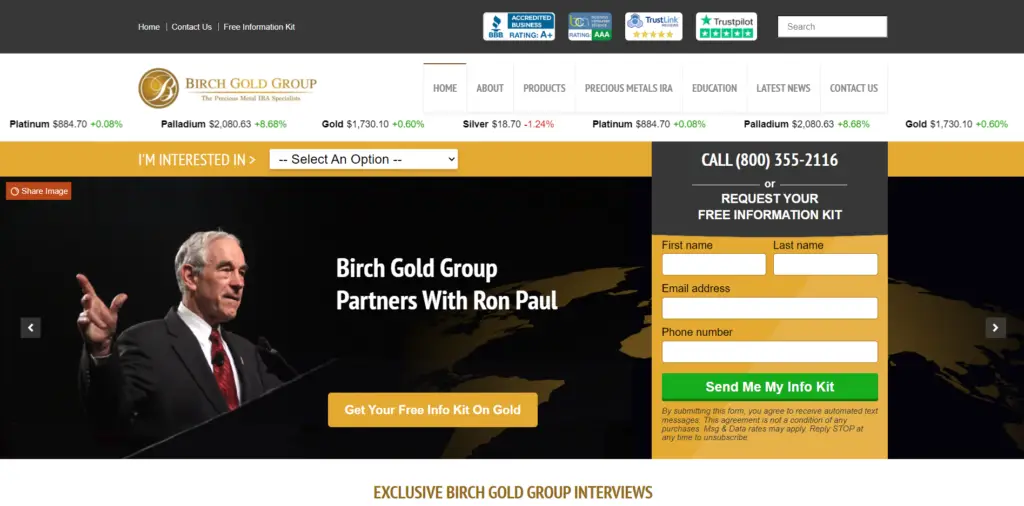

3 Birch Gold

Birch Gold is a precious metals IRA company. The company also has an A+ rating with BBB (Better Business Bureau) which indicates that it adheres to high standards when it comes to customer service, performance as well as trustworthiness.

They specialize in dealing with gold and silver and offer services for wealth protection and management.

The company provides assistance in setting up and funding your self-directed IRAs, making sure you get the help you need in purchasing your desired precious metal. They also provide knowledge and understanding of the potential risks and benefits associated with your investment.

Birch Gold Group offers extensive precious metal education resources to help you make informed decisions about your investments.

They also offer precious metal storage options to ensure the safety and security of your investments. With the option to buy gold, silver, platinum, and palladium metals, Birch Gold Group provides flexibility for clients to diversify their portfolios.

To set up an IRA with Birch Gold Group, clients need to fill out the paperwork with the help of experts from the company. The next step is to roll over an existing 401(k) or IRA, followed by choosing which precious metals to purchase.

Once the account is set up, clients must keep track of their annual contribution limits. Birch Gold Group’s reliable service, extensive resources, and flexible investment options make it one of the best Precious Metals IRA companies in the market.

Pros

- Offers all four precious metals

- Upfront pricing

- Flexible storage

Cons

- prices and demands for personal information on the homepage can be a let-off.

4 Noble Gold

Noble Gold is a gold investment company that sells gold coins, bars, and rounds. They have been in business since 2016 and are BBB rated with an A+.

The company offers IRA custodianship through its partners, and it provides a range of precious metals, including gold, silver, platinum, and palladium in both coins and bars.

Apart from precious metals for investment purposes, Noble Gold also offers Royal Survival Packs, which are a combination of various precious metals designed for emergency use.

These survival packs start at $10,000, and they are ideal for investors who want to stash physical bullion at home.

Noble Gold provides clients with a Gold and Silver Guide that includes valuable information about the precious metal investment.

It also has a secure Texas Depository for the safekeeping of precious metals. Additionally, Noble Gold offers home delivery of precious metals to clients who prefer to hold their physical assets.

Noble Gold delivers several features that make the company one of the best precious metals IRA companies. First, this proposes some of the finest gold prices on the market and equips fast, secure shipping.

Noble Gold has also acquired a ton of five-star reviews from happy customers, permitting you to probe confident in its practices. Noble Gold is number 5 in our list of 10 best precious metals ira companies 2023.

Pros

- Lower minimum investment

- Comprehensive educational resources

Cons

- Annual fees can be high for low account balances

5 Regal Assets

Regal Assets is a great option for those who want to invest in gold and silver, as well as other precious metals.

The top customer ratings and competitive pricing make Regal Assets superior among gold IRA companies.

It has a AAA rating from the Business Consumer Alliance and numerous praising reviews on additional third-party review sites.

Regal’s fee structure is evident and clear. It levies a flat rate for service and storage of $250 per year. The fee contains the price of segregated storage, which is more subordinate than most firms in this category.

Regal has also been brilliant at customer support. Regal’s IRA experts begin working with customers during the application procedure and persist to be with them in every stage of the way. Regal Assets is number 5 in our list of 10 best precious metals ira companies 2023.

Pros

- Extensive IRA rollover track record

- Zero fees for IRA rollover or transfer

- Flat annual service and storage fees

Cons

- Cannot make purchases online

6 Patriot Gold Group

Patriot Gold Group is a gold IRA company that has been in business since 2016. They have a 100% satisfaction guarantee and are accredited by the Better Business Bureau (BBB).

They assist their clients in buying, selling, and storing precious metals for investment purposes.

The company also ensures that its clients get the tax advantage of a normal IRA. In addition, they have a great customer service team that is always ready to address any concerns or queries.

To set up an IRA with Patriot Gold Group, interested clients need to contact the company experts and fill out a form with their help.

The company’s 401(K) and IRA rollover departments will then guide clients through the transfer process. Once the IRA is funded, clients can then buy and store their preferred precious metals in it.

With this straightforward process, clients can protect their life savings and potentially increase their wealth through precious metal investments.

7 Monetary Gold

Monetary Gold is an IRA company that was founded in 2000. They offer gold IRAs, gold coins, and gold bars. They have a wide variety of gold products.

Monetary Gold is your one-stop store for gold and silver investing. The company sources their precious metals straight from the exchange and etches out the middle-man: giving the savings on to you.

Monetary Gold delivers its customers the power to confidently and safely drill for retirement by funding in gold and other precious metals.

They offer a broad range of precious metals products that can serve as a fundamental way to diversify your portfolio and cover retirement portfolios during difficult times.

If you’re seeking a good spot to get begun opening a precious metal IRA, Monetary Gold is a reliable option. They deliver very low fees and account minimums to get started. This can be useful if you’re just getting started.

8 American Hartford Gold Group

American Hartford Gold Group is an IRA company that offers a wide range of investment options for gold IRAs.

Their gold IRA rollover process involves only three simple steps, making it an ideal option for beginner investors.

Clients must first speak with an AHG expert who will guide them through the paperwork and answer any questions they may have.

Next, clients must fund their accounts and choose the precious metals that best fit their investment portfolio.

AHG offers gold and silver assets or a combination of both, and the chosen metals are stored in an IRA-approved vault for better protection.

AHG provides two delivery options for the precious metals – clients can either have them physically shipped door-to-door or placed in a retirement account.

The company also offers an excellent customer service experience, with always-available customer support and an investor education program with a content library to help clients make informed investment decisions.

One potential downside is that AHG’s transaction waiting times can be longer than some other gold IRA companies.

Additionally, they do not list their prices online, which may make it challenging for clients to compare prices with other companies. AHG also only offers shipping options within the United States.

On the positive side, AHG has a variable fee structure, which means that annual service fees are directly proportional to the amount a client uses in their gold or silver IRA for a particular period. They also have a buyback program that does not charge any liquidation fees.

Overall, American Hartford Gold is an excellent option for those seeking a family-owned investment firm that offers a variety of investment opportunities and an investor education program.

Their gold IRA rollover process is straightforward, and their customer support is always available to address any concerns clients may have. American Hartford is number 8 in our list of 10 best precious metals ira companies 2023.

Pros

- Lifetime client support

- Purchase precious metals with free storage.

- Lower annual fees and buyback warranty.

Cons

- Does not post sufficiently gold price data

9 Oxford Gold Group

Oxford Gold Group has been running since 2018, and the company has more than two decades of experience in the precious metals industry.

The firm peddles investment-grade precious metals and delivers precious metal IRA retirement accounts. Oxford Gold Group also sustains A+ BBB accreditation with a ton of positive customer reviews.

Oxford Gold Group proposes IRS-approved coins and bullion, which include:-

- Gold and silver coins

- Gold and silver bars

- Platinum coins and bars

- Palladium coins and bars

For customers who are funding in precious metal IRAs, Oxford Gold Group presents a spectrum of choices, which includes:

- Traditional IRA

- Roth Gold IRA

- SEP Gold IRA

Pros

- Outstanding info for the beginner.

- Favorably rated and trusted.

- Provides Gold, Silver, Platinum, and Palladium investment options.

Cons

- No upfront pricing.

- No clear options for Platinum or Palladium IRA accounts.

If you’re glancing for a company that can spell out the facts of every part of precious metals investing, I urge giving Oxford a visit.

10 Advantage Gold

Advantage Gold is well known for its low minimum investment, low-cost fee structure, and extensive educational resources.

The company was founded in 2014, and since then they have maintained a solid track record with positive customer reviews.

Advantage Gold is without a doubt one of the best precious metals ira companies in today’s time. The company has received top ratings from the BCA (AAA) with no complaints in the last three years.

It’s easy to set up an IRA with Advantage Gold, you just have to apply for the application and it will be reviewed by one of the company professionals and then you can fund your account or rollover an existing retirement account.

Their training program is created to provide you make an advised decision when opening your precious metals IRA.

Advantage Gold’s fees and account minimums are very attractive for new investors. For customers’ storage needs, the company operates with Brink’s Global Services USA, Inc and Delaware Depository, both favorably admirable vault companies. Advantage Gold is number 10 in our list of 10 best precious metals ira companies 2023.

Pros

- Comprehensive educational resources

- Lower annual fees

Cons

- Online buys are not available

Disclosure: Our content is reader-supported. If you click on certain links we may make a commission. Learn More.